Mr Speaker,

It was announced that the grant for resale HDB flats will be increased in order to make resale flats more affordable for first timers. This is exactly the price spiral I spoke about during the debate on public housing 2 weeks ago.

The resale grant will push up demand for resale flats and therefore increase resale prices, which would later necessitate a further increase in resale grant, feeding into a continuous price spiral. More tax revenue would also be needed to fund the additional grants.As land cost is determined based on resale transactions, the increase in resale prices would result in higher land cost. The amount that HDB pays to SLA for land would increase, thereby increasing the cost of new flats. This would mean that either new flat buyers have to pay more, or subsidies and grants for new flats must be increased to make new flats affordable. More tax revenue would be needed to fund any increase in subsidies and grants.

Such a cycle of more and more tax revenue being needed to be paid into reserves in the form of land prices is unsustainable and places an unnecessary tax burden on taxpayers. Let me explain why I say it is unnecessary.

DPM and Finance Minister has said that we continue to be in a financially tight situation and the reserves drawn out to fund the covid packages were unlikely to be paid back. An occasional paper from MOF on medium-term fiscal projections has also warned of the need to raise further taxes to fund the expected increase in expenditures.

Under such an environment, any increase in subsidies and grants for housing will necessitate an increase in taxes.

This situation is caused by the way we treat land sales proceeds. Under current practice, the proceeds from the sale of land is put into the reserves. The government argues that to do otherwise would reduce the value of the reserves. PSP begs to differ.

Back in the days when land was sold on a freehold basis, this practice made financial sense and is the prudent thing to do. PSP agrees with this approach.

However, when land is sold on a leasehold basis, this practice should have been reviewed. Since land reverts to the state at the end of the leasehold period, there is no reduction in the value of the reserves at that point. On what basis do we claim that our future generations have been deprived? The same piece of land the government now owns will still belong to the government 99 years later, or 20 years later, or at the end of any other lease period.

The land sale proceeds is payment for the use of the land over the lease period. This is similar to rental payments which is also payment for the use of land over a fixed period, albeit a shorter one. Whether the use of the land is given on a 3 year basis, 20 year basis or 99 year basis, the same principle applies.

At the previous Budget, I have argued that land sales proceeds should be treated as revenue divided over the period of the lease. I have also illustrated via a table how this can grow into a significant revenue stream in a steady state.

MOF’s response to my proposal then was that this is a different concept. They do not deny the soundness and financial prudence of the proposal.

Today I venture further to point out that the situation we are facing with home affordability issues highlights how the current practice of putting land sales proceeds into reserves is not sustainable and places unnecessary tax burden on taxpayers.

The increasing land cost that necessitated higher subsidies and grants in order to keep houses affordable makes higher taxes necessary.

However, if the land sale proceeds were taken as revenue, higher land costs mean higher revenue which can fund the higher subsidies and grants without needing higher taxes. There is inherent stability in this approach and the concept is sound.

Against the backdrop of the tight fiscal position shown in MOF’s paper, if we continue with the current accounting practice, the tax burden of HDB subsidies and grants will get increasingly painful in the years ahead.

Proceeds on the sale of leasehold land is income generated from land reserves, similar to the investment returns from our Sovereign Wealth Funds. Treating the proceeds from sale of leasehold land as revenue is thus similar to NIRC. Whereas in the case of financial assets we may need to retain part of the investment returns to ensure the value of the assets keep up with inflation, the value of the land that reverts to the State at the end of the lease period is inflation-proof.

PSP therefore urges the Government again to review its accounting treatment of land sales proceeds.

Coming after the announcement of the 2% GST hike, MOF’s paper warning of tax increases raises worries of further tax burdens on the people who are already straining under the rapid increase in cost of living.

The additional taxes in this year’s budget have fallen primarily on individuals rather than companies. For example, higher GST, higher taxes on tobacco and higher-end properties and vehicles. Companies, on the other hand, have either new tax incentives or existing ones extended.

PSP is of the view that the more profitable companies should pay more taxes.

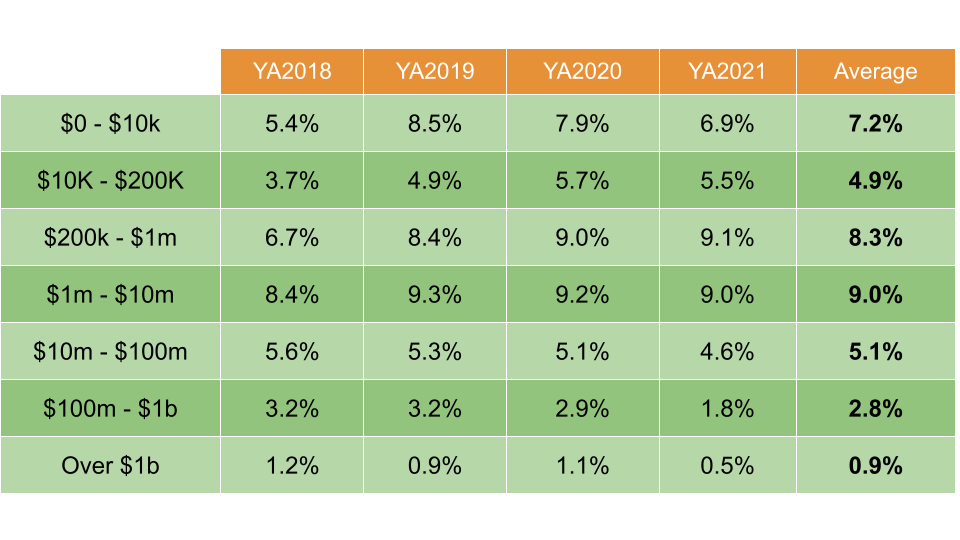

Based on MOF’s reply to my Parliamentary Question on corporate taxes paid by companies of different profit levels, it is seen that for YA2018 to YA2021, companies earning profits before tax of between $200k to $10m paid on average 8% to 9% of their profits as taxes. Those with higher profits paid a lower percentage.

Companies earning between $10m to $100m in profits paid on average 5.1% of their profits as tax. For companies earning between $100m to $1bn in profits, 2.8%. For companies with profits beyond $1bn, 0.9%.

Companies with the highest profits actually pay the lowest percentage of their profits as tax!

To illustrate, a company making $2m in profits pays 9% of its profits as taxes. This is 10 times the rate of a company that makes $2bn in profits, ie 1000 times the profit.

This is highly inequitable.

In their reply, MOF stated that effective tax rate should be calculated based on percentage of chargeable income, not profits before tax. I disagree.

Profits before tax is calculated based on internationally accepted accounting standards but chargeable income is affected by things like: which expenses are tax deductible and which are not, what income is taxable and what is not, which capital expenditure can be expensed over 1 year and which over longer, etc. In other words, chargeable income has already incorporated part of our tax policies and treatments.

Therefore, to see the full effect of our tax policies on companies in a wholistic manner, not just of the corporate tax rate, but also tax incentives, exemptions and other treatments, we should be comparing the amount of tax paid with profits before tax.

We should review the tax incentives and treatments given to companies earning profits beyond $10m so that they pay more taxes. For example, if companies earning above $1bn in profits pay just 3% of their profits as taxes instead of the current 0.9%, the additional revenue raised would be about $5bn per year!

It is time for companies to pay a fairer share of their profits as taxes. Even in the absence of any global agreement, this is something we should do, not because we are forced to and it need not be tied to any global timetable.

We have traditionally used low corporate tax as a means to attract investments. When the global minimum corporate tax is implemented, this strategy will lose effectiveness. With the loss of this tool, it has become even more urgent for us to find ways to address the high cost in Singapore. With higher corporate tax revenue, we can use that to lower business cost and cost of living to offset the higher effective tax rate thereby making Singapore still an attractive investment destination and provide relief to Singaporeans. PSP therefore urges a thorough review of our policies on property and transport to bring down costs.

In conclusion, we urge that

(i) land sales proceeds be taken as revenue divided over the lease period to ease the tax burden on taxpayers and

(ii) for more profitable companies to pay more taxes and to use that additional corporate tax revenue to lower cost in Singapore.

Thank you.